AARP urges Congress to pass much-needed federal tax credit for nation’s family caregivers

WASHINGTON, DC—AARP commends the sponsors of the bipartisan Credit for Caring Act that would help support America’s family caregivers by offering a federal tax credit of up to $3,000 annually for those who qualify. The Credit for Caring Act was introduced in the U.S. Senate (S. 1151) by Senators Joni Ernst (R-IA), Michael Bennet (D-CO), Shelley Moore Capito (R-WV), and Elizabeth Warren (D-MA), and in the U.S. House (H.R. 2505) by Representatives Tom Reed (R-NY) and Linda Sánchez (D-CA).

“Family caregivers often risk their own health and financial security in order to assist their parents, spouses and other loved ones. They tap into their savings accounts, stop saving for their future, and neglect their own health care,” said AARP Chief Advocacy and Engagement Officer Nancy LeaMond. “The Credit for Caring Act will help with the financial challenges faced by family caregivers today. AARP urges Congress to enact this bipartisan legislation this year.”

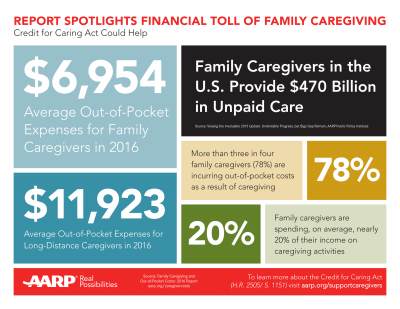

More than three quarters (78%) of family caregivers pay out-of-pocket to provide care for their loved ones, spending an average of nearly 20% of their annual income in 2016. In dollars, this amounts to roughly $7,000 annually in out-of-pocket costs related to caregiving expenses. Long-distance family caregivers spent even more, averaging nearly $12,000 last year. Many family caregivers dip into savings, cut back on personal spending, save less for retirement, or take out loans to make ends meet.

“Support for family caregivers is not a partisan issue—caregiving touches all of our lives,” LeaMond added. Across party lines, a strong majority (87%) of likely voters age 50 and older support a tax credit for working family caregivers, according to an AARP poll conducted November 6-8, 2016.

The Credit for Caring Act would provide family caregivers who work some financial relief by helping with the cost of services such as in-home care, adult day care, respite care, and other types of support. Specifically, the bill would give eligible family caregivers the opportunity to receive a tax credit for 30% of qualified expenses above $2,000 paid to help a loved one, up to a maximum credit of $3,000.

About 40 million family caregivers across the U.S. provide 37 billion hours of unpaid care, valued at an estimated $470 billion annually. By helping older adults and people with disabilities live independently in their homes and communities, these family caregivers also save taxpayer dollars, delaying or preventing more costly nursing home care as well as preventing unnecessary hospital stays.

For more information on AARP’s advocacy to support family caregivers, visit www.aarp.org/supportcaregivers.

# # #

About AARP

AARP is the nation’s largest nonprofit, nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age. With nearly 38 million members and offices in every state, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, AARP works to strengthen communities and advocate for what matters most to families with a focus on health security, financial stability and personal fulfillment. AARP also works for individuals in the marketplace by sparking new solutions and allowing carefully chosen, high-quality products and services to carry the AARP name. As a trusted source for news and information, AARP produces the world’s largest circulation publications, AARP The Magazine and AARP Bulletin. To learn more, visit www.aarp.org or follow @AARP and @AARPadvocates on social media.