New federal tax credit to help family caregivers who spend own money to care for loved ones

En español | WASHINGTON—AARP endorses the bipartisan Credit for Caring Act introduced in the U.S. Senate and the U.S. House of Representatives today, and commends the sponsors. This bill would give a federal tax credit of up to $3,000 annually to eligible family caregivers.

The Credit for Caring Act was introduced in the Senate (S. 1443) by Senators Joni Ernst (R-IA), Michael Bennet (D-CO), Shelley Moore Capito (R-WV), Elizabeth Warren (D-MA), Tammy Baldwin (D-WI), Angus King (I-ME), Richard Blumenthal (D-CT), Jon Tester (D-MT), and Chris Coons (D-DE), and in the House (H.R. 2730) by Representatives Linda Sánchez (D-CA) and Tom Reed (R-NY).

“Many family caregivers are using their own life savings, cutting back on personal spending, setting aside less for retirement, or taking out loans to help loved ones live independently,” said AARP Chief Advocacy and Engagement Officer Nancy LeaMond. “The Credit for Caring Act would help with the financial struggles experienced by millions of caregivers and we urge Congress to pass it.”

The Credit for Caring Act provides some financial relief by helping with the cost of in-home care, adult day care, respite care, and other services. The bill would give eligible family caregivers the opportunity to receive an annual tax credit for 30 percent of qualified expenses above $2,000 paid to help a loved one, up to a maximum credit of $3,000.

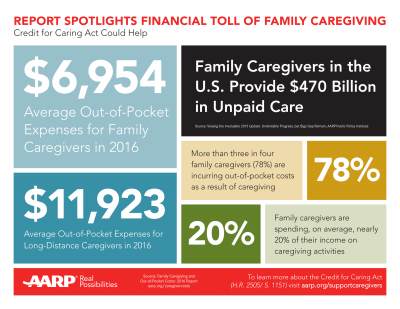

About 40 million family caregivers across the U.S. provide 37 billion hours of unpaid care, valued at an estimated $470 billion annually. By helping older adults and people with disabilities live independently in their homes and communities, caregivers help save taxpayer dollars by preventing more costly nursing home care and avoiding unnecessary hospital stays.

More than three quarters (78 percent) of family caregivers pay out-of-pocket to provide care for their loved ones, spending an average of nearly 20 percent of their annual income in 2016, according to an AARP Research report. This equals roughly $7,000 each year in out-of-pocket costs related to caregiving expenses. Long-distance family caregivers spent an average of nearly $12,000.

A strong majority (87 percent) of likely voters age 50 and older support a tax credit for working family caregivers, according to an AARP poll.

AARP’s letter to the Senate endorsing the Credit for Caring Act may be found here.

# # #

About AARP

AARP is the nation’s largest nonprofit, nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age. With nearly 38 million members and offices in every state, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, AARP works to strengthen communities and advocate for what matters most to families with a focus on health security, financial stability and personal fulfillment. AARP also works for individuals in the marketplace by sparking new solutions and allowing carefully chosen, high-quality products and services to carry the AARP name. As a trusted source for news and information, AARP produces the world’s largest circulation publications, AARP The Magazine and AARP Bulletin. To learn more, visit www.aarp.org or follow @AARP and @AARPadvocates on social media.

Media Contact: Greg Phillips, 202-434-2560, media@aarp.org, @AARPMedia